If you buy into the Silicon Valley cliché, startup expenses boil down to a team of coders with gaming laptops, some cloud infrastructure, workspace in a hip incubator and an endless supply of Red Bull, all paid for by TechCrunch Disrupt prize money.

In the real world, there’s a bit more to it.

In robust economic times, startups can often get enough venture capital (VC) funding to launch a business in style without any plan on how they’ll become profitable. But those days seem to be over, for now anyway. Profitability is the new metric, and as any business school grad knows, strong unit margins depend on keeping a lid on costs right from the start.

For a startup, spending freely while relying on sales to keep your business in the black is a risky strategy. You need to scrutinise all spending—costs to establish your company, services, inventory, payroll, equipment, marketing, software, legal fees, even whether to hire a controller—then prioritise, document and continually assess.

What are Small Business Startup Costs?

Many new businesses, excited by their big ideas, neglect the careful planning and meticulous accounting needed to manage expenses. They rely instead on an expected flood of customers to keep operations afloat—sometimes with abysmal results, judging from small-business survival statistics.

You do need a plan, but you don’t need to start from scratch. In some instances, your market’s government might provide an appropriate template:

- Australia: Calculate the start-up costs of your business

- New Zealand: How much money do you need to start a business?

- Singapore: Cost of setting up a business in Singapore

For the markets not included above – you can download this free worksheet we put together to help you calculate your startup costs.

You’ll face different startup expenses depending on your business type, though most companies will need some equipment and supplies, communications and collaboration technologies, licenses and permits, professional services such as a lawyer and for-hire bookkeeper or accountant, advertising and marketing, and a website to reach customers.

Key Takeaways

- Estimating both one-time and ongoing costs ensures your business has enough capital to sustain itself for a period of time without completely relying on sales.

- Document, document, document: To get a loan, you’ll need copies of agreements with key suppliers and clients, a projection of expected income and costs and more. So, keep records.

- Typical small business startup expenses include research, licensing fees, payroll, insurance and rent.

Small Business Startup Expenses Explained

Startup costs are the expenses needed to launch a new business. Some, like costs to qualify to get into a type of industry or business, such as getting a license to practice law or sell real estate, aren’t deductible. But you there are some things that are tax deductible, including:

- Legal, brokerage, accounting, appraisal and similar costs incurred to acquire a capital asset

- Customer surveys and other market research expenses

- Site selection costs when choosing a physical location

- Incorporation and partnership filing fees

- Salaries and wages for employees who are being trained and their instructors.

- Deductible interest and taxes, such as real estate

Different businesses will have different types of expenses—a professional services firm may want offices, while an ecommerce store needs warehouse space. However, there are a few types of expenses that are common for most types of businesses. What’s important to know is whether your local tax authority considers a cost a capital expense—that is, an asset, like machinery, office furniture or company vehicles, that’s carried on the balance sheet and depreciated over a set period of time.

Classification is important when looking to reduce business taxes because capital purchases are typically amortised or depreciated meaning the expense is spread out over several years. It’s also crucial to determine a launch date for your business. From there, figure out the time period during which you can deduct startup costs. In most cases, you can go back as far as one year from your business’ startup date.

Why Calculate Startup Costs?

Calculating startup costs gives you a snapshot of the costs to launch and fund your business. How much do you need for one-off expenses, such as furniture? That shows how much capital you need for your business to open its doors.

Understanding recurring or ongoing expenses, such as payroll and cost of goods sold (COGs), helps you analyse your cash flow needs, so you know how much revenue you need to at least break even. It also makes it easier for you to set aside enough money—say, six months’ worth of ongoing expenses—so you’re not heavily dependent on business revenue right away, or at least until you’re past the early stages.

Importance of Outlining Startup Costs in Your Business Plan

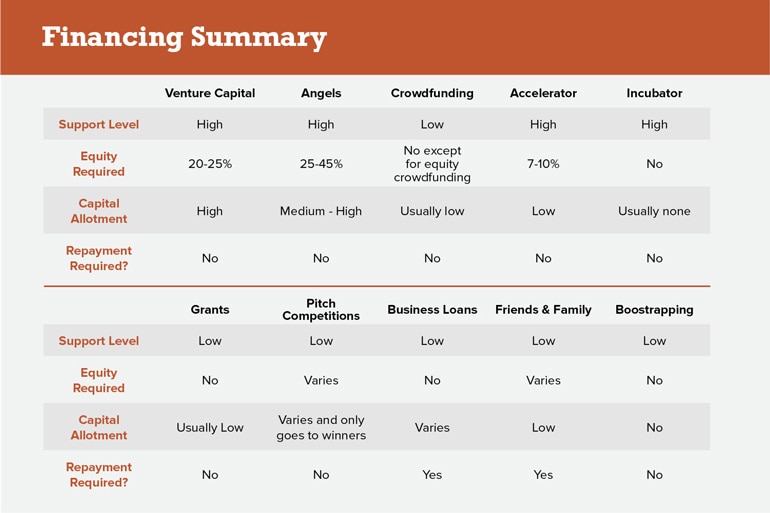

While venture capital has dominated headlines in the business press, in truth it’s relatively few companies that pursue this financing route: In 2020, the VC industry spent more than US$112 billion to fund just 5,091 Asia-Pacific companies. Many more businesses rely on credit cards, loans and lines of credit to fund their startup costs.

But whatever route you take, you must know approximately how much you’ll need before seeking outside funding. The documentation required for most loans includes copies of agreements with key suppliers and clients along with a detailed one-year projection of expected income and costs, with a narrative on how you expect to make those numbers match up.

10 Common Small Business Startup Expenses

Though the list below is divided into one-time and ongoing startup expenses, you’ll notice some of them overlap. What’s important is being thorough and honest about your expectations.

One-time expenses

-

Research expenses: A business plan provides an overview and a map of your new business. It will force you to consider costs and different strategies to ensure your business’ longevity. This includes carefully researching the industry you’re in, your target market and the best tax structure for you. If you’re hiring a market research firm, this expense needs to be put in your business plan.

-

Borrowing costs and raising funds: Most small-business owners take on debt from banks. Depending on the financial institution, you may need to pay an initial fee, such as an application or origination fee. Of course, there will also be ongoing costs in the form of principal and interest payments.

-

License and permit fees: Depending on the nature of your business, you may need to obtain authorisations and inspections to get your business license or permit. Some industry-specific permits may cost more than others. You’ll also need to factor in filing articles of incorporation or articles of organisation, depending on state guidelines.

-

Equipment and supplies: All businesses need some type of supplies and equipment. These costs may be one-time or ongoing, depending on whether you make a purchase outright or decide to lease.

Ongoing Expenses

-

Marketing: Advertising and promotion aren’t only for the early stages. You’ll need to develop and implement a marketing plan that should be factored into ongoing costs. And, don’t neglect a PR strategy, which can increase brand visibility and build trust with the public.

-

Payroll and benefits: The cost of human resources includes wages, salaries, commissions, bonuses, stipends and any employee benefits you have. Planning on fair compensation ensures lower turnover and attracts talent to your organisation. This cost can also include contractors if you’re not hiring employees.

-

Insurance: Business insurance can include workers’ compensation and short-term disability. Experts warn to be careful of overspending here. Also consider insurance to protect your customers as well as your personal assets from any business-related legal liabilities. Insurance can either be an annual or monthly cost.

-

Utilities: Water, electricity, internet and phone bills are common costs for brick-and-mortar businesses. These costs can also apply to home office spaces, but you generally can’t deduct all your utilities when working from home.

-

Technology: Technological expenses include the cost of a website, information systems and business software, including accounting and payroll software. Some small-business owners choose to outsource these functions to managed IT service providers or virtual CFOs or accountants to save on payroll and benefits, while others choose to purchase software-as-a-service (SaaS).

-

Inventory: Businesses such as those in the retail, restaurant and manufacturing sectors may need to purchase initial inventory to start and budget for ongoing operations. You must carefully calculate to ensure there is enough inventory to operate, but not so much that you’re stuck with items that aren’t necessary or may spoil. The importance of good inventory management is hard to overstate.

#1 Cloud

Accounting

Software

How to Calculate the Cost of Starting a Business

Calculating your small business startup costs can help attract investors and estimate when you’ll start making a profit. Below are the basic steps to get started.

- Create a list of necessary expenses. This includes one-time and ongoing costs.

- Research estimated costs. Get as close as you can to the real cost of each item on your list. Your research should include comparing different vendors to help you minimise expenses without sacrificing quality. Depending on your business, research can include equipment leases, rent, office supplies and contractor salaries.

- Total up expense amounts. Add up your one-time expenses. Then, look at how much your ongoing expenses will cost for one month and multiply that figure by several months to calculate your initial total startup amount. How many is “several”? That depends on when you realistically expect to see revenue or additional funding.

- Add a cushion. A six- to 12-month cushion will help you keep your operations going, since it is difficult to forecast sales accurately to start.

- Tally up the final amount. Add the cushion amount to your initial estimates to arrive at the final number.

Using Expense Management Software to Track Startup Expenses

Calculating small-business startup expenses will be a much more streamlined process when you use expense management software. Software also helps to automate the expense reporting process, so you can see right away how much of your funding goes to paying for reimbursable operating expenses.

Plus, if you work with others on a team, having a single source of data that syncs in real-time makes collaboration easier. It also helps you to document your expenses easily for tax reporting and auditing.

Small Business Startup Expense FAQs

What are examples of startup costs?

Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

What is the average startup cost for a small business?

Since businesses and industries have different requirements, costs depend on variables such as whether you need office or warehouse space, physical inventory and licensing. That’s why it’s crucial to estimate costs, such as expenses you'll incur before your business officially opens, assets aside from cash and a cushion in the event of operating deficits during the early stages.