All the Formulas You Need to Get Started

The guide has everything you need to understand and use a periodic inventory system. You’ll find basic journal entries, formulas, sample problems, guidance, expert advice and helpful visuals.

What Is Periodic Inventory?

Periodic inventory is an accounting stock valuation practice that’s performed at specified intervals. Businesses physically count their products at the end of the period and use the information to balance their general ledger. Companies then apply the balance to the beginning of the new period.

Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock. Organisations use estimates for mid-year markers, such as monthly and quarterly reports. Accountants do not update the general ledger account inventory when their company purchases goods to be resold. Instead, they debit the temporary account purchases. A temporary account begins each year with a zero balance. The accountant removes the balance to another account at the end of the year.

Companies make any necessary adjustments from purchasing goods to a general ledger contra account. A contra account is meant to be opposite from the general ledger because it offsets the balance in their related account and appears in the financial statements. Examples of contra accounts include purchases discounts or purchases returns and allowances accounts. Combining these accounts provides the net purchases.

In a periodic inventory control system, companies also keep delivery costs in a separate account from the main inventory account. They track delivery costs related to incoming inventory Freight In or Transportation In accounts. Eventually, the costs in this account increase the value of their inventory. In the journal, the accounts would look like this:

Key Takeaways

- Periodic inventory is an accounting inventory method where inventory and cost of goods sold are calculated at the end of an accounting period rather than on a daily basis.

- Periodic inventory systems can make sense for small to midsized businesses with a low number of products sold, while large and growing business opt for the perpetual inventory method and its higher accuracy.

- Periodic tracking is easy to implement but limits the details you know about your inventory at any given time.

Periodic Inventory Explained

With a periodic inventory system, a company physically counts inventory at the end of each period to determine what’s on hand and the cost of goods sold. Many companies choose monthly, quarterly, or annual periods depending on their product and accounting needs.

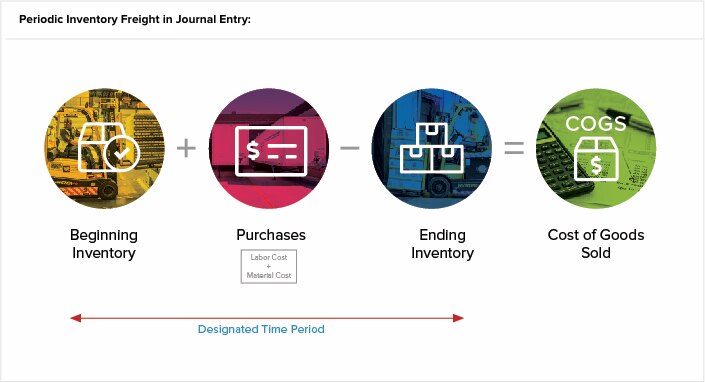

Rather than update their books with current inventory and cost levels on an ongoing basis, businesses take the beginning inventory level, ending inventory and purchases made during that period for cost calculations.

Periodic inventory works for businesses that don’t need to accurately know current inventory levels on a daily basis. It works well for small businesses looking to keep costs low. Growing businesses and larger businesses need more detailed inventory tracking and typically choose a perpetual inventory system, which is best managed using an ERP inventory module.

While it doesn’t give business decision makers real-time data, periodic inventory is just fine for many small businesses, particularly those with few unique SKUs to update at the end of each period.

What Is a Periodic Inventory System?

The periodic inventory system is a software system that supports taking a periodic count of stock. Companies import stock numbers into the software, perform an initial physical review of goods and then import the data into the software to reconcile.

These software systems support your current stock-keeping method. You can use them to get paper inventory lists, import the stock data and calculate the data you need to order more stock and reconcile the stock you have for a new period. Companies can export these figures and reports to accounting software. A company will choose the software based on its needs and the requirements of its products.

Catherine Milner and Geoff Relph are co-authors of “Inventory Management: Advanced Methods for Managing Inventory within Business Systems(opens in a new tab)” and “The Inventory Toolkit: Business Systems Solutions”. As owners of Inventory Matters, Ltd., they consult with clients and advise choosing a software system for inventory management that does the upfront work.

Milner explains: “We see many companies trying to implement inventory management business systems that do not have the features or requirements they need. The most important thing is to know what you need precisely. When someone comes to sell you a system, their measures of success may not be the same as your business’s measure of success. Whether it is your business, the sales business or the hosting business, each has a different focus. So ensure yours is the one that drives the sale.”

Relph adds, “For example, when you buy a car, you know what you want. The salesperson may have a vehicle that does not exactly fit your request. His job is to persuade and sell you more than you need. When you drive away, you realise you cannot operate the vehicle effectively. As a buyer, beware. You should buy what you need and not an approximation of what you think you want. Whether this happens as a matter of choice or misunderstanding, it hardly matters. This is not a criticism but is reflective of the industry.”

Under a periodic system, the software should show the cost of inventory recorded as per the last physical count — it does not update based on sales. Companies register the purchases made between counts in the purchases account. The software makes journal entries based on transactions out of the inventory and cost of goods sold (COGS) accounts to user-defined accounts. Other features of periodic inventory software include:

- User-defined accounts set for different combinations of books and subsidiaries.

- Creation of journal entries in the background based on a scheduled script.

- Custom reports such as Journals Created Today, Journals Not Needed for Transactions Created Today, Error Reports and Modified Transactions.

- Customised software roles, such as the Principal Accountant.

What Is the Cost of Sales?

The costs of sales are the direct expenses from the production of goods during a period. These costs include labour and materials costs but exclude any distribution or sales costs. The formula for COGS, or costs of sales, is:

If you do not have a true beginning inventory, calculate the beginning inventory as the remaining stock from the previous period. The accounting period can be in months, quarters or a calendar year. The COGS in a perpetual system is rolling, but you can calculate it for a period.

Let’s say our product manager, Cristina, wants to know if she is pricing her company’s generic Bismuth subsalicylate high enough to leave a healthy profit margin. If she calculates the COGS as $10 per 100-mL bottle, she will need to price each bottle higher than $10 so her company can comfortably turn a profit.

Cristina’s business uses the calendar year for recording inventory and records the beginning inventory on Jan. 1 and the ending inventory on Dec. 31. The company accountant valued the Jan. 1 beginning inventory of generic Bismuth subsalicylate at $49,000, or 4,900 bottles. During the year, generic Bismuth subsalicylate costs the company $40,000 for materials and labour. On Dec. 31, the company accountants valued the ending inventory at $30,000. Therefore,

When Is a Periodic Inventory System Used?

A small company with a low number of SKUs would use a periodic system when they aren’t concerned about scaling their business over time. Depending on your products and needs, you could also use a periodic system in concert with a perpetual system.

Any business can use a periodic system since there’s no need for additional equipment or coding to operate it, and therefore it costs less to implement and maintain. Further, you can train staff to provide simple inventory counts when time is limited or you have high staff turnover. For example, seasonal staff may come and go. They can quickly count the goods they are working with, whereas a perpetual system, which provides a more accurate inventory, requires training staff on electronic scanners and data entry. Learn more about a perpetual system and how it gives a more precise inventory solution by reading our “Guide to Perpetual Inventory”.

You can also use a periodic system if you have a handle on your supply chain process, sell a few products and have eyes on your goods as they flow through your business. A periodic system isn’t useful if you need to investigate to identify missing inventory or unbalanced numbers. This issue will arise as your operation grows and becomes more challenging to control positively.

Milner describes periodic systems as “a simple approach to inventory management which is useful for those small organisations which have a simple approach to inventory management. These businesses don’t necessarily have a defined relationship between the raw materials or purchased items and the final sold product. One example of a business that would use a periodic system is a food bank. They would frequently count the physical inventory to determine the closing inventory quantity.”

The Benefits of a Periodic Inventory System

The main benefits of employing a periodic inventory system are the ease of implementation, its lower cost and the decrease in staffing needed to run it. It only takes a little time to add a periodic system to your business. Simple counts on legal paper can suffice for collecting product data, especially if you only offer a few goods. A basic count during the day or week is often enough for a small business to get an adequate handle on their inventory. This means there is no need for expensive or complicated equipment, just essential information collection tools – pen and paper.

One big negative, however, is that you are only collecting minimal information, usually just a discrete product count. Further, you do not collect or report this data in “real-time.” You update stock numbers at distinct periods and not when you buy or sell them. In fact, you will not have much information to go on should you need to track your products from beginning to end or investigate shortfalls or overages. You can’t quickly identify the source of issues.

Other negatives with a periodic system include:

- Errors in Estimation: In the periods between stock inventories, you must estimate the cost of goods sold and which products and quantities are available. This estimate may be far from the actual COGS once you have completed a physical count.

- Significant Adjustments: In the periods between stock-taking, there is no way to account for losses, overages or obsolete goods. This could result in substantial, costly adjustments after your next physical count. The only time a periodic system is current is directly after the stock-taking and the accounting events.

- Inability to Scale: A periodic system does allow for some room to grow, as it is based on your ability to track your goods. However, scaling your business with a periodic system becomes more time-consuming and onerous as you grow and add products to your inventory.

Challenges of Periodic Inventory

While periodic inventory is easy to implement, it comes with several noteworthy drawbacks around the level of detail you get and how often your information is updated.

To make good business decisions, most business owners and managers need updated information on a very regular basis. Most large businesses update inventory automatically with each sale or shipment. This is easily achieved with a modern ERP. Whenever you make a purchase at a retail store or online, the retailer knows exactly what was sold and when so it can make decisions around restocking.

Businesses with periodic inventory in place may not realise a product is running low until a customer asks why it isn’t on the shelf. Even worse, you could make an online sale only to find the item isn’t in stock and backordered with your supplier. Both are far from ideal customer experiences and can add extra stress on your staff.

Even many small businesses use inventory tracking systems tied to their point of sales (POS) or online store. When the cashier scans a barcode and a customer walks out with a product, the inventory is automatically updated. Sophisticated businesses may setup automatic reordering so they never run out of stock.

The ongoing information also helps businesses keep more granular information on cost per item sold, which is a major factor in profit margins and overall profitability. For large businesses or growing businesses, operating with a periodic inventory system is akin to operating your business with blinders. You don't have the full picture until the end of the period.

What Is a Perpetual Inventory System?

A perpetual inventory system is a software system that continuously collects data about a company’s products. A perpetual system tracks every transaction as it happens, including purchases and sales. The system also tracks all information pertinent to the product, such as its physical dimensions and its storage location.

A perpetual system is more sophisticated and detailed than a periodic system because it maintains a constant record of the inventory and updates this record instantaneously from the point of sale (POS). However, perpetual systems require your staff to perform regular recordkeeping. For example, in a periodic system, when you receive a new pallet of goods, you may not count them and enter them into stock until the next physical count. In a perpetual system, you immediately enter the new pallet in the software so the system can track its life in your business. When there is a loss, theft or breakage, you should also immediately record these updates.

According to Relph, “When an organisation grows such that all items require a SKU (e.g. internet sales), then it is highly likely this business will need to move towards a perpetual inventory system.”

A perpetual system is superior to a periodic system in many ways, especially for companies that are considering their longevity. Implementing a perpetual system earlier in the company’s inception enables staff to have a long-term record of the inventory and also keeps the business from growing out of a periodic system one day. A perpetual system can scale, so whether you have five products (today) or 200 products (tomorrow), a perpetual system can effectively manage inventory control.

Periodic vs. Perpetual Inventory Systems

Periodic and perpetual inventory systems are different accounting methods for tracking inventory, although they can work in concert. Overall, the perpetual inventory system is superior because it tracks all data and transactions. However, with a perpetual system, you need to make more decisions to use it successfully.

“Periodic systems are better with unknowns. Not all periodic systems have computer systems attached since computer logic does not do well with many unknowns,” explains Relph. “Once your business grows, you need to define those unknowns to make a perpetual system work. You must define the products, assign SKUs and then make decisions about the relationships between what you buy and sell.”

Between the two accounting systems, there are differences in how you update the accounts and which accounts you need. In a perpetual system, the software is continuously updating the general ledger when there are changes to the inventory. In the periodic system, the software only updates the general ledger when you enter data after taking a physical count. In a perpetual system, the COGS account is current after each sale, even between the traditional accounting periods. This method also makes the calculations less time-consuming. In the periodic system, you only perform the COGS during the accounting period.

One other key difference between the two systems is the accounts you use. In a perpetual system, you record purchases or inventory under the merchandise or raw materials account when you make them, updating the unit count entry for the individual record, whereas in a periodic system, you document purchases into a purchase asset account, which means an individual record for unit counts isn’t available.

Examples of Periodic Transaction Journal Entries

In a periodic inventory system, you update the inventory balance once a period. Typical journal entries for this system are simple. You can assume that both the sales and the purchases are on credit and that you are using the gross profit to record discounts.

The gross profit method is an estimate of the ending inventory in the period. You can use this in the interim period, the time between physical counts, or to estimate how much stock you lost in the case of a catastrophic event. This calculation is an estimate. Accountants do not consider it as an airtight method to determine the annual inventory balance, as it is not precise enough for financial statement reporting.

Follow these steps to calculate the gross profit estimate:

- Calculate the cost of goods available for sale (COGAFS): Add the beginning inventory (BI) and the cost of purchases (P) for the period (COGAFS = BI + P).

- Estimate the cost of goods sold (COGS): Multiply the sales (S) for the period by [1 – the expected gross profit % (EGP%)]. This calculation gives you COGS = S * (1-EGP%).

- Estimate the ending inventory: Subtract the COGS from the COGAFS, or step #1 – step #2 (EI = COGAFS – COGS).

In a periodic system, you enter transactions into the accounting journal. This journal shows your company’s debits and credits in a simple column form, organised by date.

Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable.

Record the purchase discount by debiting the accounts payable account and crediting the purchase discount account.

Record the total accounts payable purchase and accompanying discount in an entry together that debits the accounts payable and credits the purchase discounts account.

Record the purchase returns by debiting the accounts payable or accounts receivable account and crediting the purchase returns account.

Record inventory sales by crediting the accounts receivable account and crediting the sales account.

Record sales discount by debiting the sales discount account and crediting the accounts receivable account.

Record your total discount in your journal by combining the inventory sales and the sales discount entries.

Record your sales return by debiting your sales returns account and crediting your accounts receivable or accounts payable.

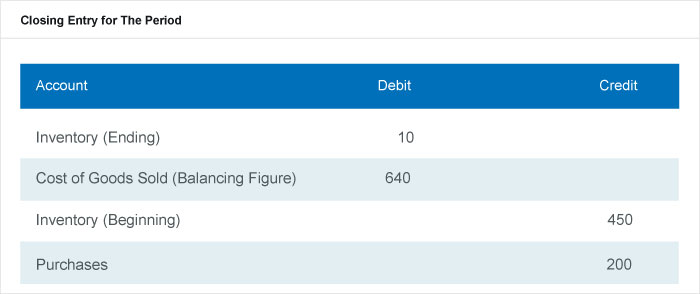

Complete the closing entry at the end of the accounting period, after the physical count. You can calculate the COGS by using a balancing figure or the COGS formula. In this entry, the debits are in the ending inventory rows and the COGS row, and the credits are in the beginning inventory and the purchases rows.

Award Winning

Cloud Inventory

Example of Periodic Systems

Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts.

Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory. Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale. They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average.

Cost Flow Assumption Diagram

Periodic FIFO

FIFO means first-in, first-out and refers to the value that businesses assign to stock when the first items they put into inventory are the first ones sold. Products in the ending inventory are the ones the company purchased most recently and at the most recent price. In a periodic FIFO inventory system, companies apply FIFO by starting with a physical inventory. In this example, let’s say the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. Purchases over this period are in the following table.

Over January, this company had 1,950 units from the beginning inventory and purchases. A periodic system doesn’t track each sale during this period. Therefore, 1,950 units – 590 units from the physical count = 1,360 units. This number is how many units you expect have been sold and should expect to be in COGS.

This company pulled into COGS the full purchases and costs from 1/1/2019 and 1/2/2019 and only pulled what they required from the 1/7/2019 purchase to meet their calculated COGS amount from above (110 units). In a FIFO system, this company uses the first inventory in before they move to more recent inventory (and prices). It put leftover units into the ending inventory, making it 590 units at $2,960 that it will also put into the beginning inventory for the next period.

This company will list the following figures on its monthly income statement:

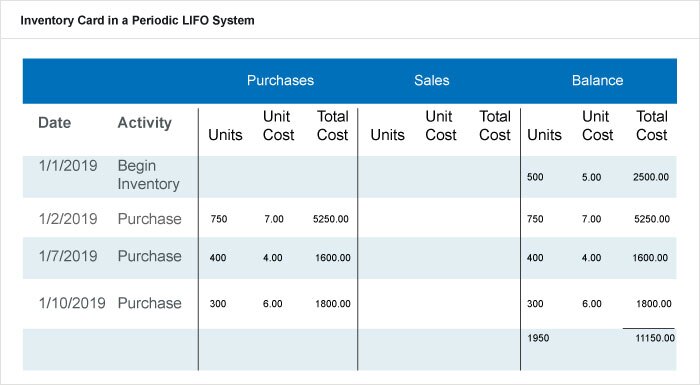

Periodic LIFO

LIFO means last-in, first-out, and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. LIFO in periodic systems starts its calculations with a physical inventory. In this example, we also say that the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. We use the same table (inventory card) for this example as in the periodic FIFO example.

Over January, this company had 1,950 units from the beginning inventory and purchases. You don’t worry about tracking each sale during this period. Therefore, 1,950 units – 590 units from the physical count = 1,360 units. This amount is the number of units that you expect are sold and should expect to be in COGS.

Different from a FIFO system, a LIFO system pulls the latest purchases into the COGS calculation. The accountant took the purchases last made 1/10/2019, 1/7/2019, and 660 units from 1/2/2019 and put them into COGS with their accompanying costs. Leftover items going into the ending inventory were 90 units from the 1/2/2019 purchase and what was in the beginning inventory, giving the 590 units. This company counted the total cost of $3,130, which will go into the beginning inventory for the next period. Here’s how they will list the following figures on their monthly income statement:

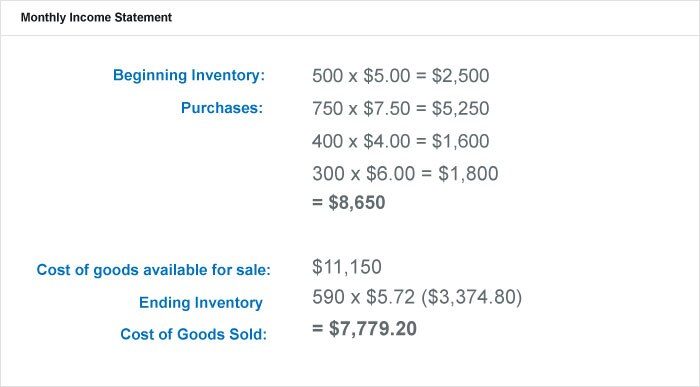

Periodic Weighted Average Costing (WAC)

Weighted average cost (WAC) in a periodic system is another cost flow assumption and uses an average to assign the ending inventory value. Using WAC assumes you value the inventory in stock somewhere between the oldest and newest products purchased or manufactured.

The formula is WAC = BI + P / units for sale

To maintain consistency, we’ll use the same example from FIFO and LIFO above to the calculate weighted average. In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. The same table for this is below.

Before going further, the company calculates the weighted average of the purchases over the period from the total cost divided by the total units over the period, or $11,150/1,950 units = $5.72 per unit. From this figure, it would incorporate the physical inventory the company counted of 590 units. Here is how it will list the following figures on its monthly income statement:

As you can see, weighted average in a periodic system is a calculation done outside of the ledger. In this method, you calculate an average for the period instead of moving transactions over when the company bought or sold something during the period.

Perpetual FIFO

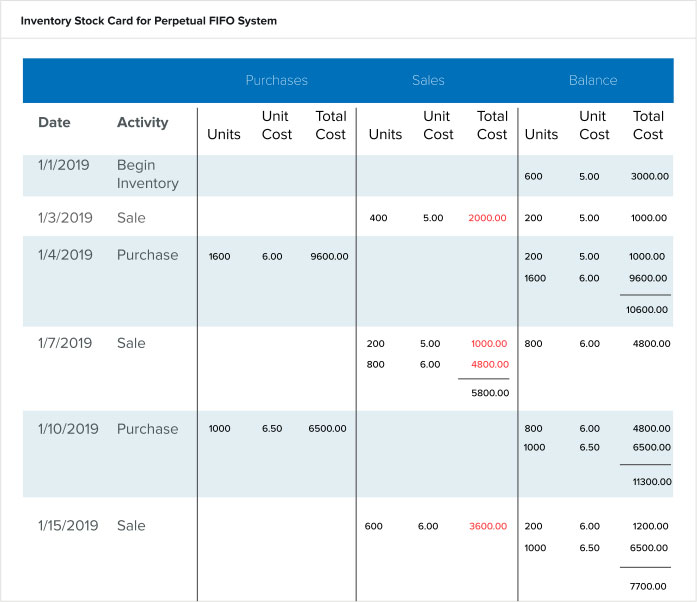

In a perpetual FIFO system, the company includes the sales as they happen in the ledger. The company should still perform physical inventories, but only to confirm the accuracy of the ledger’s data. They would perform these either yearly or by cycle counting. The biggest difference in the ledger in a perpetual system as compared to a periodic system is that the balance is a running tally of not only the units but the value (or total cost) of those units. The unit cost moved over in the balance is based on when the stock sold comes in. Stock maintains the value the company purchased it for throughout its lifecycle in the company. For example, stock purchased on 1/4/2019 for $6.00 per unit maintains that value through its sale. See the running tally in the chart below.

At the end of the period, the ending inventory is already calculated as the last entry. For this period, it is 1,000 units at a total cost of $7,700.00. The cost per unit is $6.50, or the last purchase unit cost for the period. You’d calculate COGS from this ledger by going to the Total Cost in the Sales column and adding the figures for what the company sold during that period. These are the figures in red, or $2,000 + $1,000 + $4,800 + $3,600 = $11,400.

Perpetual LIFO

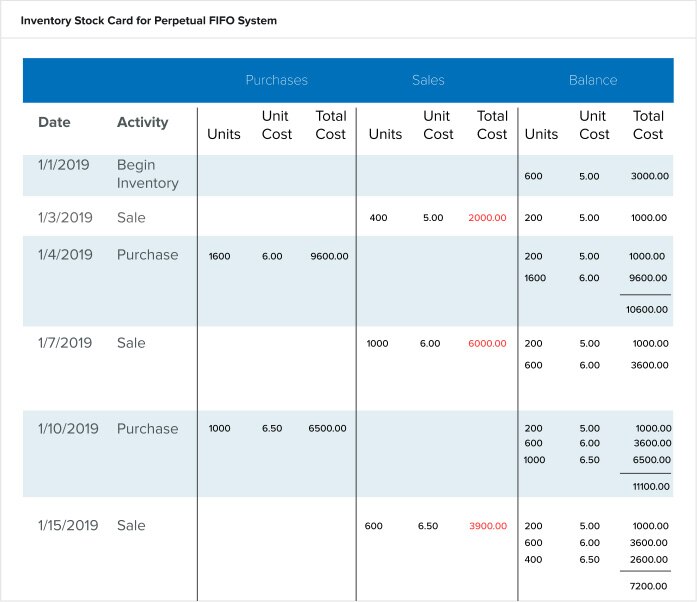

In a perpetual LIFO system, the company also uses the running ledger tally for purchases and sales, but they sell the inventory that they last purchased before moving to older inventory. In other words, the cost of what they sell is the same as what they most recently paid for that inventory. See the same activities from the FIFO card above in the LIFO card below.

Notice the difference in the unit cost of the sales and what carries over to the balance. The sales transaction on 1/7/2019 is most notable. The FIFO card noted two separate transactions of sales (for 200 units at $5.00/unit and 800 units at $6.00/unit) under two different costs. In the LIFO card, there was enough inventory at the most recent cost ($6.00 per unit) to fulfil the sales request by the single entry. This entry is for the most recently purchased inventory at the most recent price.

Tally the ending inventory shown at the bottom of the card. It is 1,200 at three different unit costs, adding up to $7,200 for the period. Calculate the COGS by adding the Total Costs in the Sales column (the figures in red). COGS reflect what the company sold by the actual prices the units sold for. Therefore, COGS = $2,000 + $6,000 + $3,900 = $11,900.

Perpetual Weighted Average Costing

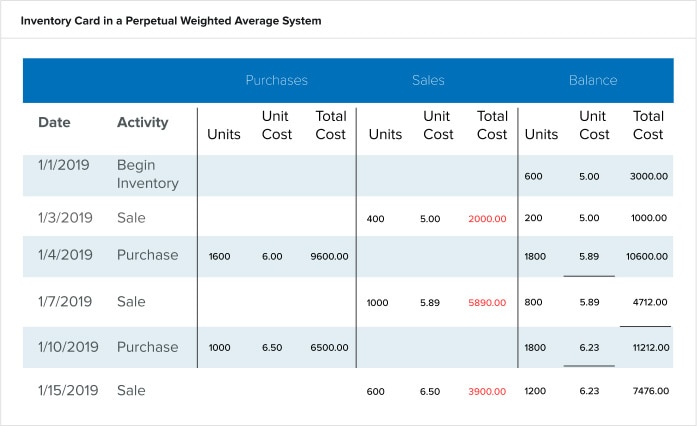

In a perpetual weighted average calculation, the company keeps a running tally of the purchases, sales and unit costs. The software recalculates the unit cost after every purchase, showing the current balance of units in stock and the average of their prices. The next sales transaction reflects this newly calculated unit cost. See the same activities from the FIFO and LIFO cards above in the weighted average card below.

Notice the difference in the unit cost after every purchase. The system recalculates the unit cost and value of total cost based on the average of what is still in stock and what the company has added in their purchase. The ending inventory figure is the last numbers on the card: 1200 units at $7,476.00. Calculate COGS by adding the total costs of what the company sold (in red). COGS = $2,000 + $5,890 + $3,900 = $11,790.

Specific Identification

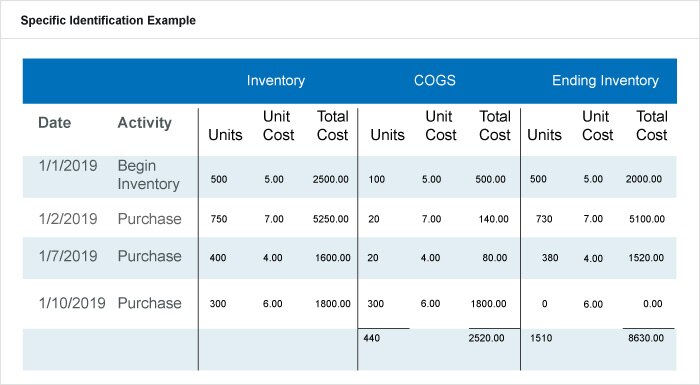

The specific identification method is the same in both a periodic system and perpetual system. Although not widely used, this method requires an extremely detailed physical inventory. The company must know the total units of each good and what they paid for each item left at the end of the period. In other words, the company attaches the actual cost to each unit of its products. This is simple when the products are large items, such as cars or luxury technology goods, because the company must give each unit a unique identification number or tag.

The example below has the same activities as above, except the company tracks each unit individually and what it purchased. Then, it performs a detailed physical inventory, reporting back each unit sold by the date the purchase was made.

They report the ending inventory for each purchase date first, then add them up. The ending inventory for this period is $2,520 for 440 units. Calculate COGs for each line item, and then add them together to get the period’s COGS. In this example, COGS is $8,630.00.

NetSuite Can Help Provide Visibility Into Your Inventory

Properly managing inventory can make or break a business, and having insight into your stock is crucial to success. While the periodic method is acceptable for companies that have minimal inventory items or small businesses, those companies that plan to scale will need to implement a perpetual inventory system. Regardless of the type of inventory control process you choose, decision makers need the right tools in place so they can manage their inventory effectively. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts. Find the right balance between demand and supply across your entire organisation with the demand planning and distribution requirements planning features.

Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow.

Periodic Inventory FAQs

What is periodic inventory system with an example?

A periodic inventory system is an accounting method where inventory tracking is updated manually at the end of a specific period. For example, a small retail store with one location may choose periodic inventory to make record keeping simpler and may choose to update their inventory records on a quarterly basis for estimated tax calculations.

What is periodic inventory taking?

Periodic inventory taking is the physical count of inventory that takes place on a periodic schedule when using a periodic inventory method. Even businesses using perpetual inventory may want to take a physical inventory count periodically to account for shrinkage (theft, broken, and lost items).

What is the difference between periodic and perpetual inventory?

Businesses using periodic inventory update their inventory records on a regular schedule, often monthly, quarterly, or annually. Perpetual inventory requires regular updates but offers more in-depth and timelier inventory information.

Who would use a periodic inventory system?

Periodic inventory systems are best for smaller businesses with just a few products to track. As businesses grow and track more unique SKUs, periodic inventory systems become less viable.