The economy needs small businesses to rebound: Before the pandemic, companies with fewer than 499 employees accounted for nearly half of the private-sector workforce, and the U.S. Small Business Administration Office of Advocacy’s 2018 SMB Profile says these firms drove 44% of all U.S. economic activity.

Many were hit hard by the pandemic and are working to come back stronger, while others found their goods and services in high demand. But all small businesses—from startups to firms that have been in business for decades—need the right financial resources to ensure they can continue to serve their customers, pay their employees and be dynamic members of their communities.

Note that this is not a rundown of top challenges facing small businesses now, like liquidity issues or neglecting required reporting. These are must-haves to address these and other problems.

Five Small-Business Financial Needs

There are a number of ways small companies can use smart financing and tax strategies to increase the cash reserves they have available to invest and grow.

But first, they need to get a handle on exactly where their money is going.

1. Cash flow management

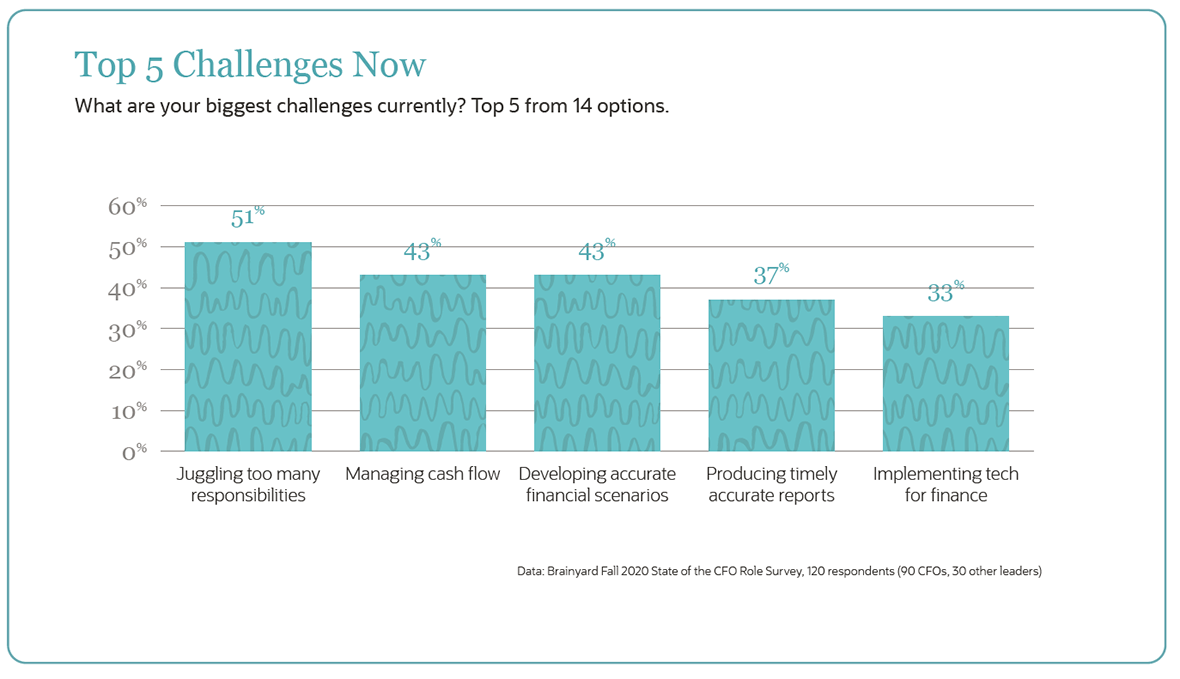

Cash flow is a perennial problem for small businesses. In fact, September’s U.S. Census Bureau Small Business Pulse Survey showed that only 28% of the businesses surveyed had enough cash on hand to operate for three months. In our own Brainyard Fall 2020 State of the CFO Role survey, where 66% of respondent companies have 150 or fewer employees, cash flow remains near the top of the list of challenges.

To cover shortfalls, small-business owners often dig into their own pockets. More than half of respondents in the Federal Reserve Small Business Credit Survey reported that they have used personal savings or funds from family and friends to support their businesses within the last five years.

And if they look to outside lenders—their reported next step—some 88% have used their personal credit scores to secure financing.

Issues that drive small-business cash flow woes include variable revenue patterns for seasonal businesses, a lack of accounts receivable systems and difficulty projecting expenses and deciding where to allocate funds.

To maintain cash flow during a downturn, the SBA says to tightly manage inventory make sure money isn’t tied up in unused goods or raw materials. Besides better cash flow, benefits of inventory management include the ability to quickly fill customer orders and decrease the amount of stock that goes unsold.

In addition, ensure your cash flow analysis stays up-to-date, and make sure to project your forecast out three months.

Other cash flow management best practices include providing several payment options to make shopping more convenient for your customers and earning more per customer by using, for example, upselling and cross-selling of related and higher-margin products and services.

Automating the accounting process can help deliver accurate projections and make invoicing timelier and more accurate—which can speed accounts receivable collection and thus boost cash flow. Automation also helps the business take advantage of discounts for early payments and provides insights so small business can negotiate with suppliers for better payment terms to keep more cash on hand longer.

Robert Half’s 2019 Benchmarking Survey found that some 39% of firms with less than $499 million in revenue use financial software—with the most likely functions to be automated including invoicing, financial report generation, data collection and document storage and compliance.

2. Proactive tax management

Taxes are another perennial, and time-consuming, problem. Of 1,000 businesses surveyed by the National Small Business Association, one-third spend more than $500 per month on payroll services, which are necessary to manage deductions, including local, state and federal income taxes straight.

Another one-third of small businesses spend upwards of 40 hours per year dealing with federal taxes alone, and the majority—63%—spend more than $1,000 each year just to pay Uncle Sam.

Complexity and changing tax codes are also on the minds of small-business owners. For instance, the National Foundation for Credit Counseling points to changes put in place by the Tax Cuts and Jobs Act that may allow for cash-basis accounting—that is, to pay taxes only on income received.

Unsurprisingly, 68% of NSBA respondents said they hire external tax practitioners or accountants to prepare their taxes. That’s a smart move: Accountants can ensure accuracy in complying with changing tax codes and take full advantage of tax credits to reduce the bill.

Best practices to minimise taxes include choosing the proper business structure for your company and being mindful of changes under the Tax Cuts and Jobs Act, which no longer allows businesses to deduct certain expenses.

And, if your company is now allowing employees to work from home, make sure you understand the tax implications, including nexus, sales and use taxes, tangible personal property taxes and credits and incentives.

#1 Cloud

Accounting

Software

3. Alternative funding

When it comes to external funding, The Hartford found that most small businesses start by seeking bank loans. But they’re increasingly open to newer options: 42% said that they would consider alternatives to traditional lenders, with owners under the age of 34 being more amenable. And in fact, the pandemic may have given this trend a boost, as many fintech companies were approved to accept PPP applications and facilitate loans.

An important first step is to assemble a financial statement that provides a formal record of your company’s financial activity and current status and a snapshot of how well you expect to perform in the future. Financial statements are required for audits and are very useful for tax, financing and investment activities.

Alternative funding methods and options include:

-

Crowdfunding: This is the most popular form of alternative financing. Many small businesses are familiar with the so-called “reward-based” crowdsourcing promoted by Kickstarter and Indiegogo. These platforms offer “investors” presale of the product or other rewards in exchange for donations. While the U.S. Chamber of Commerce says the average campaign raises a modest $7,000, there are some standout success stories. For instance, the game “Exploding Kittens” eventually raised more than $8 million on Kickstarter.

There are also emerging forms of crowdfunding for small businesses.

Debt-based crowdfunding is essentially a peer-to-peer loan. Prosper, Kiva and Lending Club are examples of P2P lenders from which a small business can look to raise capital in the form of loans or promissory notes to be paid back at a fixed interest rate.

Regulation crowdfunding allows eligible private companies to offer and sell securities in order to raise large amounts of capital—currently a maximum of $1,070,000 in a 12-month period. Businesses using this form of crowdfunding are required to disclose information in filings with the SEC, investors and the broker-dealer or funding portal. The SEC also requires that all transactions take place online through an SEC-registered broker-dealer or funding portal.

So how promising is this route? The SEC estimates that between 2016 and 2018, there were 539 offerings that reported raising at least the minimum amount of funding requested. The median amount reported raised was approximately $107,367.

CircleUp is an example of an equity crowdfunding platform.

-

CDFIs: Community Development Financial Institutions are private financial institutions that provide loans to businesses that may not qualify for funding through a traditional finance institution because of, for example, a low credit score or lack of collateral. CDFIs are regulated by the U.S. Treasury Department. The latest data shows that nearly 75% of CDFI lenders’ portfolios went to serve low-income families, high-poverty communities and underserved populations. The U.S. Small Business Administration recently rolled out its Lender Match tool to help small businesses find CDFIs.

4. Asset leasing

The latest data from the Equipment Leasing and Finance Foundation shows that leasing is the most popular method of financing an asset, just ahead of using lines of credit or secured loans.

Leases deliver many benefits in terms of keeping cash in the company—especially right now. A September survey by the Equipment Leasing and Finance Foundation shows that 91% of 75 equipment finance company respondents have offered payment deferrals, including extensions, modifications or restructuring.

Small-business owners should be mindful of changes to accounting rules for leases including that all leases need to go on the balance sheet.

5. Insurance

Are you protected should a client be injured while at your business, given that The Hartford puts the average customer injury or property damage claim at $30,000?

The U.S. Small Business Administration lists six types of insurance a small company should consider, depending upon the nature of its business: general liability, product liability, professional liability, commercial property, home-based business insurance and a business owner’s policy, which is essentially a package of common small-business insurance products.

Companies also need commercial auto coverage for business vehicles and workers’ compensation coverage if they have employees. Like health insurance, workers’ comp is an area where many small businesses could save: Experts say 75% of companies overpay for their workers’ comp insurance.

| 5 Strategies to Reduce Health Care Costs | |

|---|---|

| Review health care data and statistics | Analyse past referrals, health care claims and records to determine best outcomes. By mining your own data, you can steer employees to the top providers. |

| Offer telemedical care | In addition to convenience for the employee, telemedicine services can save employers up to $500 per episode of care for the most common health conditions. In a year, these savings may shave up to 11% off total health care expenses. And, COVID-19 has made people more comfortable with video. |

| Embrace medical case management | Medical case management programs can reduce the cost of health care by directing your employees to the right care at the right time, place and price. |

| Request reference-based pricing | When you opt for reference-based pricing, the health insurer will specify set costs for specific health care services. Without this strategy, such services may come with wide cost variations. |

| Incentivise comparison shopping | Offer incentives for employees to do price comparisons for health care services. For example, an employee may not need a surgical practice for a simple sprain. Some insurers offer comparison tools to help employees match the provider to the issue. If yours doesn’t, ask why not. |

We also recommend considering cybersecurity insurance to minimise the risk associated with data breaches or ransomware.

Having a handle on all your options is critical if a cash shortfall should arise. Successful small businesses monitor cash flow, proactively manage taxes, keep up-to-date on alternative funding options, take advantage of asset leasing and ensure the business is protected from risk.