There are many financing options for entrepreneurs looking to build their big ideas, but one of the most sought after is venture capital (VC) funding.

In this article, we’ll cover the basics of VC, provide general tips on how to know if it’s the right funding option for your company and give an overview of the process. We’ll also explain the first three tiers of VC deals: pre-seed or startup, seed and first-round.

This first article will cover the ideas on a general level, and we’ll further explain some of the most critical lessons — like finding the right VC and successfully pitching them - in subsequent posts. So read up, do your homework, then get out there and begin pitching.

What Is Venture Capital?

Forbes offers the following definition for VC(opens in a new tab):

“Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but significant potential for growth. Fledgling companies sell ownership stakes to venture capital funds in return for financing, technical support and managerial expertise.

“VC investors typically participate in management, and help the young company’s executives make decisions to drive growth.”

VC is also sometimes referred to as “risk capital,” because there’s a risk of VCs losing their money if the early-stage business doesn’t succeed.

VC funding often comes from institutional and private investors.

Venture capital firms acquire funds from institutional investors such as pension funds, university endowments and financial firms or high net worth individuals like former entrepreneurs or angel investors. VCs then invest these funds in companies with hopes of achieving a significant return.

VCs invest in return for equity.

Venture capital investments are typically made in exchange for an equity stake, or part ownership, in a company, as opposed to being structured as loans.

VC investments include long-term partnerships between companies and venture capital firms.

Venture capitalists don’t just give you money and walk away. They often want to attend your meetings, help make decisions and give their input on how to run your company. A VC firm will stick by your company’s side until it “exits”(opens in a new tab) by “going public” in an IPO or getting “acquired” or “bought out” by a private equity firm or larger company … and that can take a while.

The average period from seed stage to exit for Southeast Asian startups, as estimated by INSEAD and Golden Gate Ventures(opens in a new tab), is roughly 7 years, across all categories. At the same time, Golden Gate estimates that the average amount of time from a Series B funding round or later to exit is 3-4 years.

Is My Company Ready For VC?

The right moment to approach VCs for investment is different for each company. It’s possible to attract a VC partner with only an idea, but the majority of deals are closed after a business has three concrete items:

- a founding team

- a minimum viable product (MVP)

- customers

In addition to these items, there are other elements that are also on the radar of many VCs(opens in a new tab), especially when it comes to early-stage startups and their founding teams:

- Ambitions

- Personalities

- Motivations

- Potential market size

Early stage ventures are characterised by where they are in the business lifecycle. They are typically highly focused on product development and testing product-market fit, establishing their first team of employees and trying to get execution down pat. Depending on the nature of the product, these businesses may be ‘pre-revenue’ — in other words, not focused on sales. Highly technical startups may be focused on getting their solution right before they take it to market at all, whereas consumer-facing products might prioritise going to market in order to more rapidly acquire customer feedback, which will in turn inform further product development.

Investors who focus on early stage ventures understand that they are taking a high amount of risk, for the potential of a super-high return. For this reason, securing funding may take longer as investors spend more time with a business to properly assess its merits.

If your business hasn’t progressed far enough yet to attract venture capitalists, a business incubator might be a good first step. Incubators like Cicada Innovations in Australia(opens in a new tab), Singapore’s Pollinate(opens in a new tab), a joint initiative of Ngee Ann Polytechnic, Singapore Polytechnic, Temasek Polytechnic and the Institute of Technical Education (ITE), and Incite Capital(opens in a new tab), based in Selangor, Malaysia, offer resources such as office space, mentorship and industry connections, as well as opportunities to secure smaller amounts of capital.

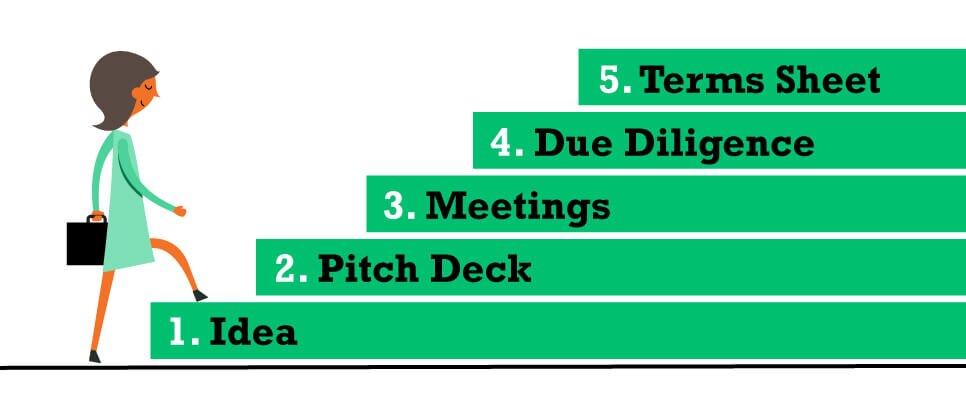

The 5 Steps to Getting VC Startup Funding

So you’ve decided VC is the right financing channel for your company, and you think your company is mature enough to pursue it. Now you need to understand and prepare for the funding process.

As a business founder, you’ll likely go through five steps on the path to VC funding:

1. Idea

First of all, you need a great business idea. But as we’ve mentioned, not every

business is right for a VC investment. Early stage venture capital firms invest in specific

kinds of companies: typically early-stage, highly-scalable businesses that can grow fast,

dominate a market and go public through an IPO. If you want to raise capital from one,

you’ll have to ensure your business fits this bill; otherwise, a different type of

financing may be your best bet.

2. Pitch

A pitch deck(opens in a new

tab)

is generally the first piece of marketing

collateral you will share with a VC firm. A pitch deck can be cold-emailed to a firm, but

the best-case scenario is to get a warm intro, which is when someone from your network

introduces you to the VC.

Early-stage pitch decks are often conceptual and idea-based, whereas decks for later stages of funding are more complex, featuring KPIs(opens in a new tab) such as engagement, traffic or revenue.

(Some entrepreneurs prefer to showcase their product in the first meeting in place of a deck. However, if the VC shows interest, the next step is almost always a traditional pitch deck or business plan.)

For tips on making a great pitch deck, visit ‘How to get VC funding from start to finish’.

3. Meetings

To secure financing for your business, you need to meet with VCs. Cold-emailing your

pitch deck to VCs is a potential way to score a meeting. However, you’ll be much

better off utilising your network as explained above.

To find the best fit, create a target list of VCs that align with your business. Fund Comb(opens in a new tab) offers an extensive database of firms located in APAC that you can search to find financiers in your industry. Then, use your network for referrals to get in touch with VCs, or do cold outreach as a last resort.

The timeline for getting a meeting is different for everyone. If you have a hot idea and a strong network with direct VC connections, it’s possible to get meetings set up within a few weeks.

But if you don’t have contacts, securing a meeting can take a long time. And even when a meeting is secured, it’s not unusual(opens in a new tab) for potential investors to take some time to get to know the founders whose business they are considering investing in long before that investment occurs.

4. Due diligence

If your first meeting with a VC goes well, there will be additional meetings—the exact

number varies greatly—and a series of due diligence steps before a VC offers a deal.

For Jackie Vullinghs(opens in a new tab),

partner at Australia’s AirTree, the due diligence process can take 2-4 weeks. Due

diligence includes reviewing the founding team, product, industry, target market, company

earnings power and financial viability of the company.

No matter how “done” your deal seems, the due diligence phase is necessary for all venture capital firms. The firm will take time to fact-check all important data and assess current assets alongside any potential risks, eventually determining whether the deal is a good fit.

5. Terms sheets & funding

If a VC wants to finance your company, they will send over a term sheet(opens in a new tab) that lays

out the details of the proposed deal. The terms sheet is a negotiable document that both

parties must agree upon. After finalising a terms sheet, the company will receive funding.

We’ll cover the specifics of terms sheets in a future post.

These five steps are the general process of securing funding from a VC. It’s not always a straight line to funding, so come prepared and remain persistent during the process.

#1 Cloud

Accounting

Software

How Long Is the VC Process?

The VC investment process typically involves exhaustive due diligence and disclosure of relevant business information before final terms can be negotiated and an investment proposal submitted, according to the Australian Investment Council(opens in a new tab) (AIC).

The AIC notes that the investment process can often take in excess of three months to complete, so it’s important for founders not to expect a speedy response from potential investors.

You don’t want to run out of money while building your business. So when approaching the VC funding process, it’s imperative to give yourself plenty of time.

Indeed, the AIC suggests it’s a good idea to plan the business financial needs early on to allow time to secure the required funding.

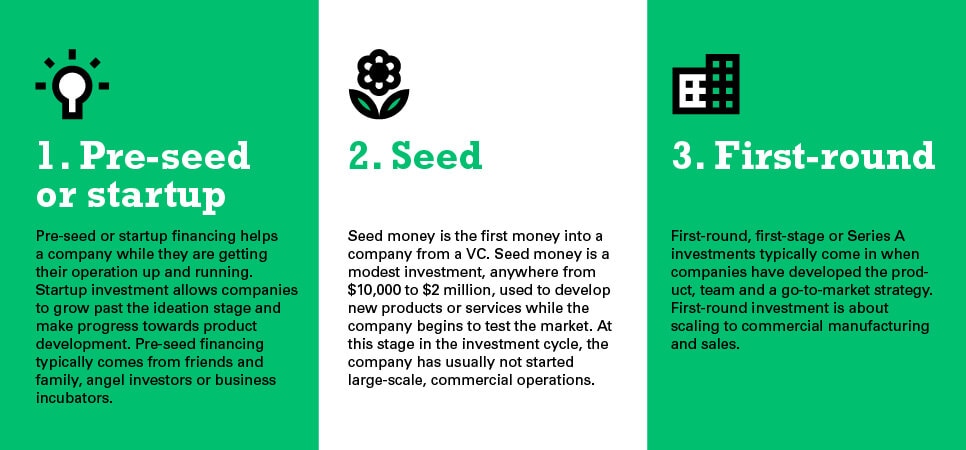

The First Three Tiers of VC Funding

For most businesses, the first interaction with a VC will take place in its early-growth stages. Early-stage venture capital financing(opens in a new tab) includes three :

Across APAC, startups seeking early-stage funding for both seed and Series rounds received a larger slice of total VC investment in 2021 than during the previous year, according to research(opens in a new tab) by data analytics and consulting company GlobalData.

Keep in mind though, some entrepreneurs get their seed or startup money from friends and family, business loans, financing through clients, or even through simple bootstrapping(opens in a new tab), before approaching VCs.